Real Advantage

The day-to-day

difference.

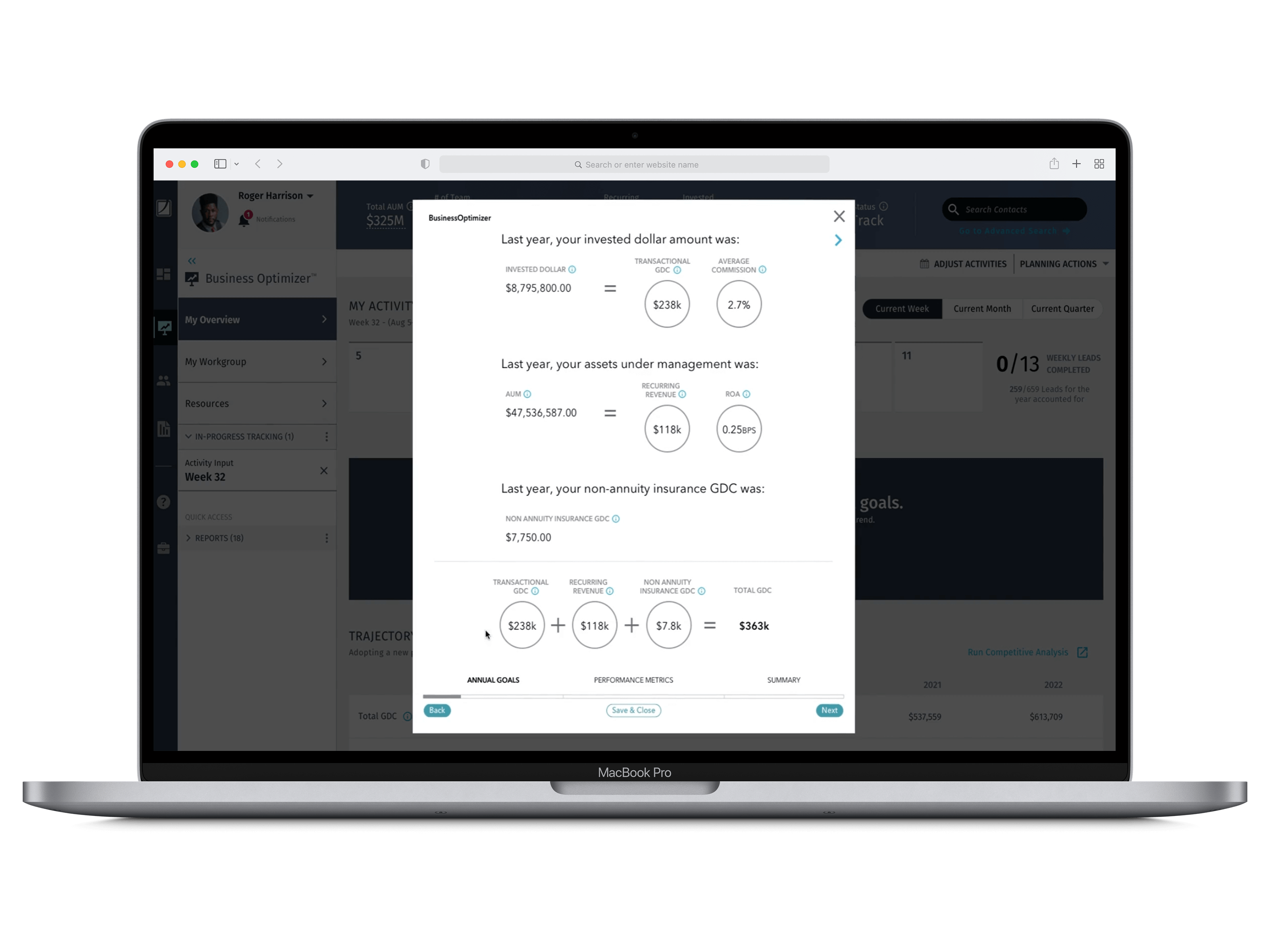

More than a tech stack. A game changer. Simple to use, our solutions transform your ability to do more business better.

Explore technologyPremium service and support. Action-oriented practice management. World-class products and solutions. Industry-leading technology.

It’s all designed to create an environment where you can thrive—and build real life value for your clients.

Real Advantage

More than a tech stack. A game changer. Simple to use, our solutions transform your ability to do more business better.

Explore technologyReal Choice

Best-in-class solutions, with multiple custodial options. Add fully-integrated technology and you’ve got the end-to-end wealth management tools to do the job efficiently—all in one place.

Explore advisoryReal Support

Your time is valuable. That’s why we answer calls in seconds, not minutes—and design everything to help you get things done in a fraction of the time. So you can do more for your clients.

How we helpReal Growth

There are many ways to grow your practice. Our experts bring the tools, resources, and guidance to help you with what’s right for your business.

Explore practice management

Real Connections

Ultimately the key is giving you more ways to understand your clients’ dreams and concerns, so you can be the one they go to for real guidance.

Why it matters

Be a part of one of the fastest growing wealth management firms.

$ 120 B AUA

2700 Financial Professionals

183 Institutions